What is a Shooting Star candlestick pattern?

Shooting Star candlestick pros and cons

Types of a Shooting Star candlestick

Difference between the Shooting Star and the Inverted Hammer

How to read a Shooting Star pattern in technical analysis

Example of the Shooting Star pattern

How to trade the Shooting Star candlestick pattern

If you want to get better at trading, learning about the Shooting Star candlestick pattern can help you spot potential market reversals and earn on them. This guide explains the Shooting Star pattern and how you can use it in your trading strategies.

What is a Shooting Star candlestick pattern?

The Shooting Star candlestick pattern is a technical analysis pattern. It offers valuable insights into market trends and often acts as an early signal of a potential reversal.

The pattern consists of the following key elements:

- A compact real body: The body is positioned close to the lower edge of the price range.

- An extended upper shadow: The upper shadow extends significantly above the real body, measuring at least twice its length.

- The smallest or absent lower shadow: A small or nonexistent lower shadow suggests little to no downward movement from the opening price.

The Shooting Star candlestick pattern may vary in appearance on your charts. The colour of the body is not a critical factor—it can be either bullish or bearish. Similarly, the presence of a lower wick is not essential to the validity of the pattern.

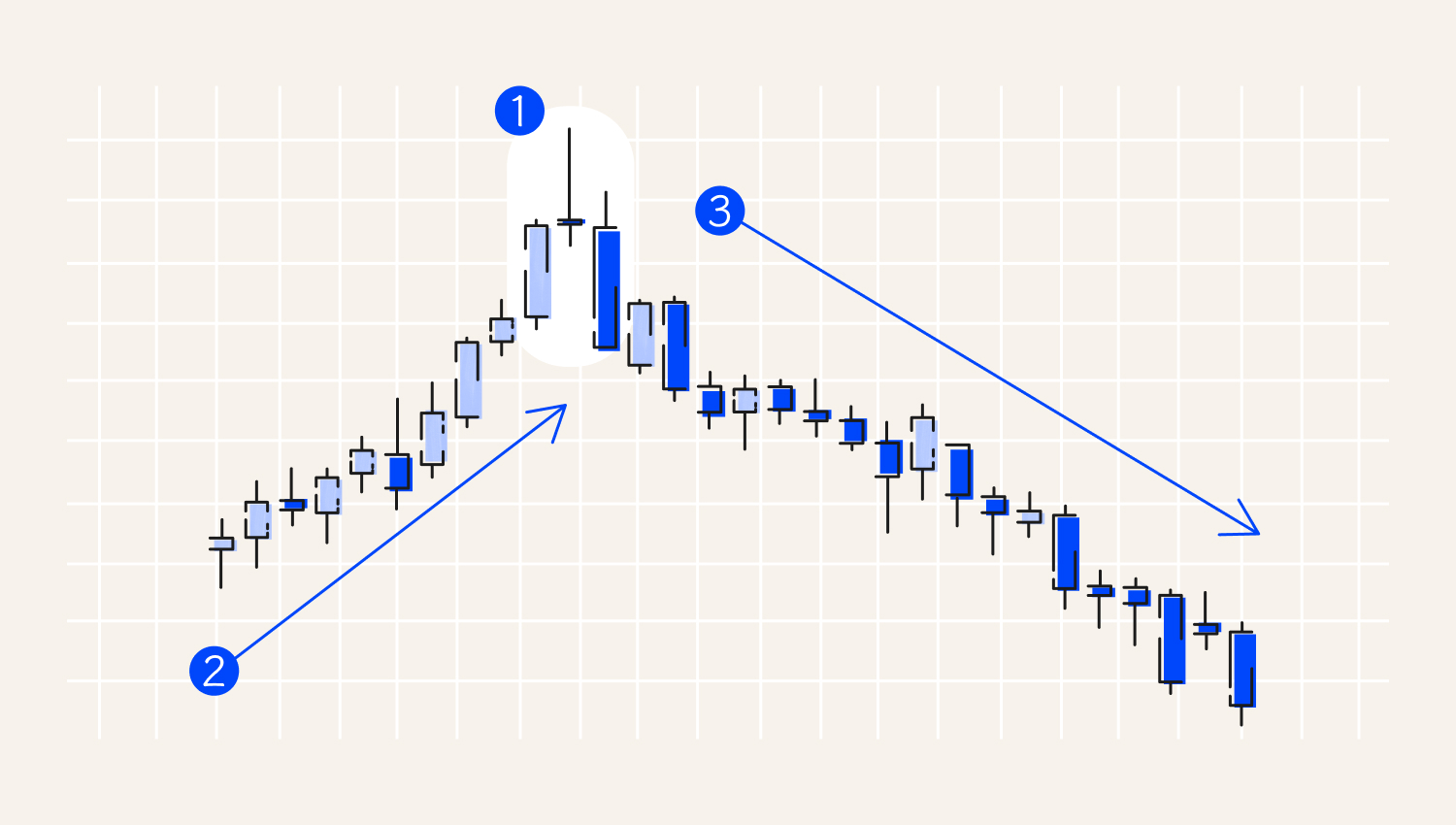

Here is the scheme of the pattern:

1. The Shooting Star

2. Bullish trend

3. Bearish trend

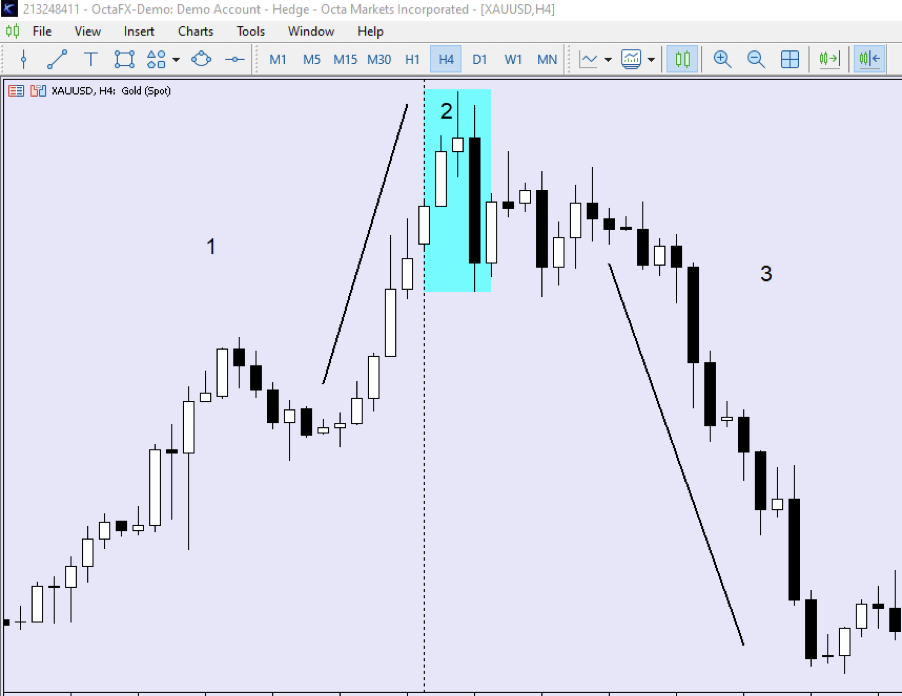

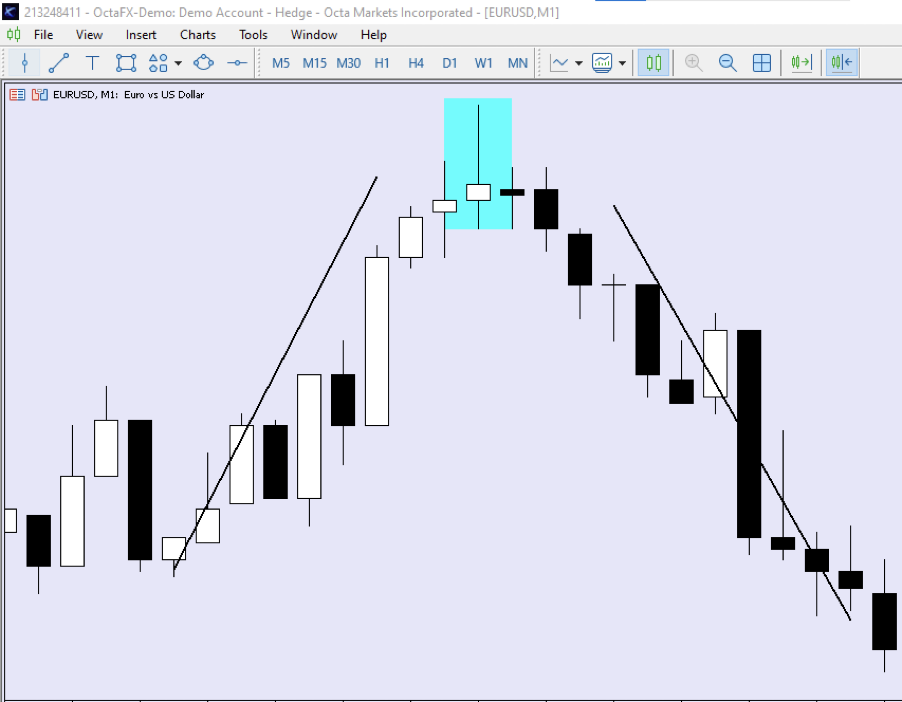

The chart below shows the Shooting Star candlestick pattern at the end of the bullish trend:

4. Bullish trend

5.The highlighted three candles (Bullish, Hammer, and Bearish) of a Shooting Star

6. Bearish trend

Shooting Star candlestick pattern pros and cons

|

Pros |

Cons |

One of the key advantages of the Shooting Star candlestick pattern is its straightforward identification on price charts. Even novice traders can easily recognise this pattern.

Shooting star candlesticks are straightforward patterns. Even beginners can easily grasp them.

Shooting Star candlesticks are the signals that can warn investors about a possible drop in prices. Knowing about these signals helps traders change their strategies to protect their investments. |

One of the main issues with the Shooting Star candlestick pattern is that it can sometimes give misleading signals. This means that after you see a Shooting Star, the price might not actually drop like expected. To avoid making a bad call, many traders look for other patterns to confirm what they see. This way, they can reduce the chances of making a mistake.

Another drawback is that Shooting Star candlesticks cannot be used out of context. More candlesticks are necessary to confirm a bearish trend reversal. Traders relying solely on a single Shooting Star may face risks from false signals. |

Types of a Shooting Star candlestick pattern

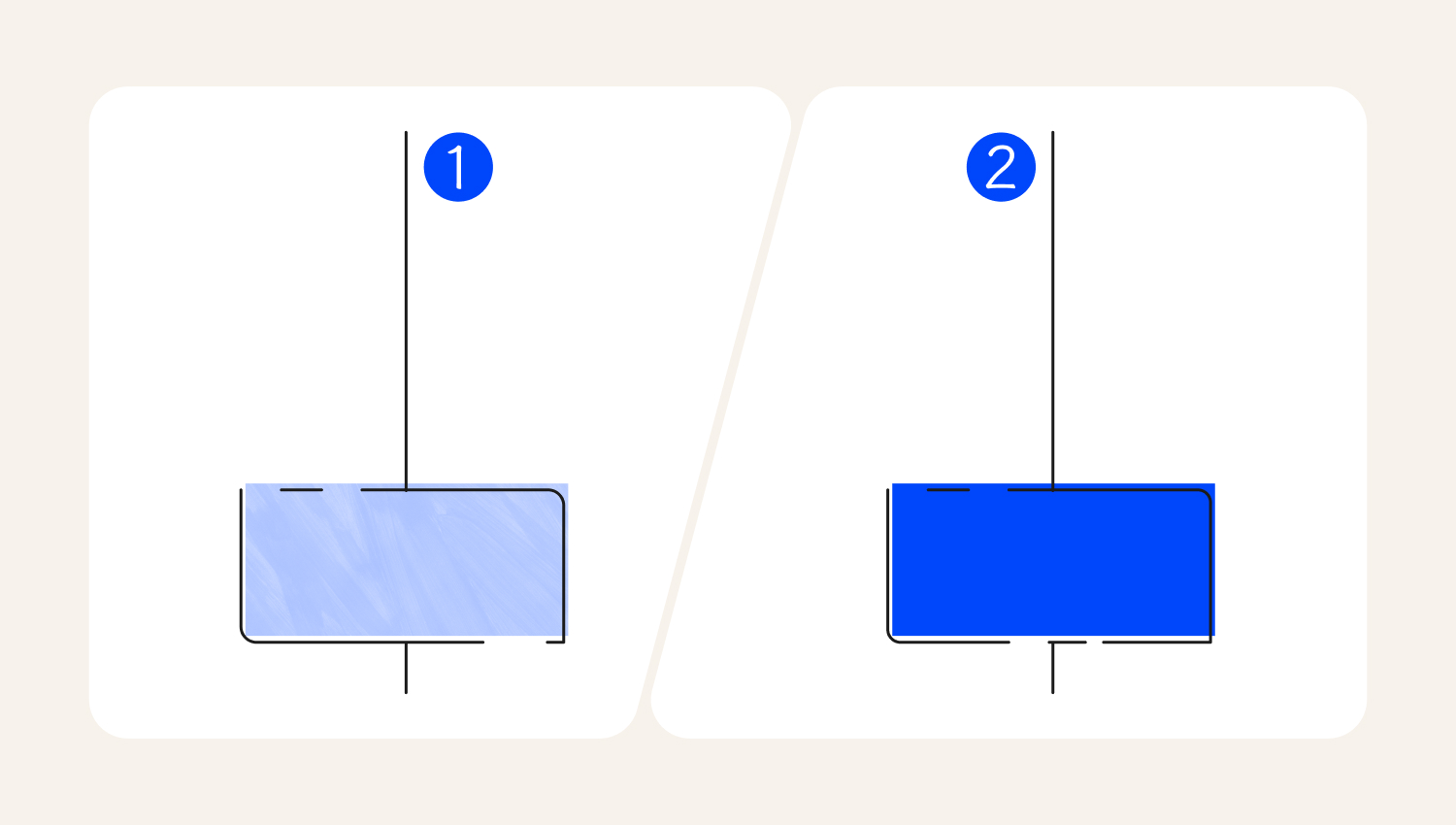

There are two main types of the Shooting Star candlestick pattern. Each type provides unique insights, and using them combined with other tools can improve your analysis.

- Bearish Shooting Star

The Bearish Shooting Star pattern is like a red flag signalling that the market is about to change direction. It usually pops up after prices have been bullish for a while, hinting that the price could have reached the highest point.

What makes it stand out is its tiny body at the bottom and a long shadow sticking up at the top. This look shows that sellers are starting to take over, which could mean prices are about to drop. The Bearish Shooting Star is a heads-up that the uptrend might be ending, so traders might think about closing their profits or even entering Sell trades.

- Bullish Shooting Star

The Bullish Shooting Star is a pattern you might see when the market is bearish. It looks a bit like the Inverted Hammer, but it's not as common. When you spot this pattern, it can mean that the asset might be bullish in the near future.

It has a small body at the bottom and a long shadow sticking up, which indicates that sellers tried to push prices down but failed. This means the selling pressure is weakening, and it could be a good time for buyers to jump in. So, if you see a Bullish Shooting Star, keep an eye out—it might be a sign that things are about to turn around.

1. Inverted Hammer

2. Shooting Star

Difference between the Shooting Star and the Inverted Hammer

The Inverted Hammer and Shooting Star candlestick patterns are both essential signals in technical analysis. Let’s analyse their main features and what they signify.

|

Name |

Description |

Meaning |

| Inverted Hammer pattern | The Hammer candlestick features a small body positioned at the upper end of the candlestick, accompanied by a long lower shadow. This formation resembles a hammer. Its compact body acts as the head and the extended lower wick represents the handle. | The Hammer pattern typically emerges after a price decline. It indicates a possible upward reversal. It reflects the resilience of buyers who have managed to drive the price back toward the opening level despite prevailing selling pressure. Traders often seek confirmation from the following candlesticks to validate this potential reversal. |

| Shooting Star pattern | The Shooting Star candlestick pattern is recognised by its small body near the bottom of the candlestick, accompanied by a long upper shadow. Visually, it resembles an inverted hammer, sharing the characteristic of a short body and an elongated upper wick. | The Shooting Star appears after a bullish trend and suggests a possible downturn. It shows that despite strong buying interest at the start, sellers have managed to push prices back down near the opening level, hinting at weakness in the prevailing uptrend. Traders often look for confirmation from subsequent candles to support this potential reversal. |

The Inverted Hammer pattern indicates that the price might start going up after a drop. On the flip side, the Shooting Star shows that prices might start going down after rising. These patterns are usually more trustworthy if they show up after an unidirectional swing in the market. To be sure about what's happening, traders often check them alongside other tools and indicators.

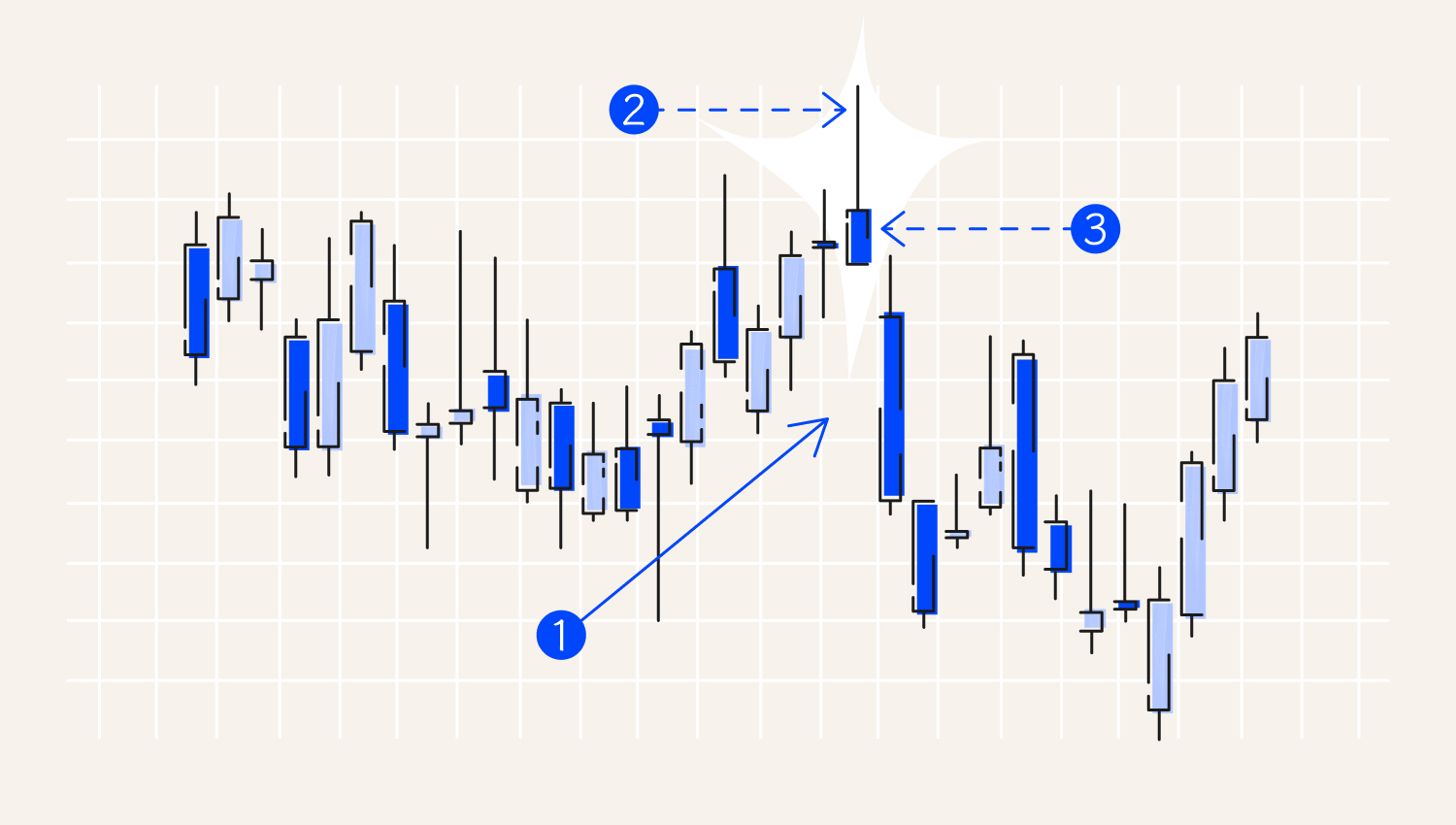

How to read a Shooting Star pattern in technical analysis

To spot the Shooting Star candlestick pattern:

- Search for an upward trend: a Shooting Star emerges following a prolonged rise in prices.

- Identify the pattern: locate a candlestick exhibiting a lengthy upper shadow and a compact body near the base.

- Verify the pattern: validate with supplementary price actions or technical indicators for added confirmation.

This is the scheme:

1. Uptrend.

2. The Upper Shadow is bigger than the Real Body.

3. The Real Body.

Example of the Shooting Star pattern

Below is an EOD (End of Day) chart for EURUSD, demonstrating an instance of the Shooting Star pattern. This chart also highlights how accurately this formation predicts a downward shift.

The Shooting Star pattern observed at the peak of a consistent uptrend led to a prolonged decline.

1. Uptrend.

2. The Upper Shadow is at least twice as big as the Real Body.

3. The Real Body is bullish or bearish—bearish is preferable.

How to trade the Shooting Star candlestick pattern

- Enter the trade. First, confirm the presence of the Shooting Star candlestick pattern. Begin by identifying a clear uptrend. Look for a candlestick with a small body and a long upper shadow. Once you spot a Shooting Star candle within this bullish trend, wait for an additional confirmation signal. A bearish candle breaking below the low of the Shooting Star's body proves the pattern's significance.

- Remember, false signals can always occur. Place a stop loss above the upper wick of the Shooting Star candle to avoid losses if the market goes against your expectation.

- Place a take profit. Determine the price target for your trade. It might be based on the size of the Shooting Star pattern. Set a profit target equal to three times the size of the pattern.

Final thoughts

- The Shooting Star candlestick pattern is significant for traders because it can signal the change in market direction.

- You usually see this pattern after prices have been going up a lot. It looks like a small candlestick body at the bottom with a long stick or shadow above and almost no shadow below.

- The pattern occurs when there's a lot of buying, but then sellers step in, causing prices to drop.

- To spot a Shooting Star, look for it during an upward trend. It's also important to watch what happens next to ensure it's a valid signal.

- Recognising the Shooting Star can help you improve your Forex trading skills.