EUR/USD regains some ground lost and re-targets 0.9800

- EUR/USD bounces off lows near the 0.9750 region.

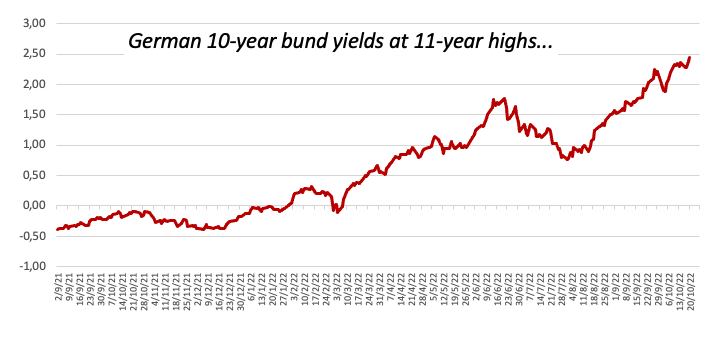

- German 10-year bund yields surpass the 2.45% level.

- Weekly Claims, Philly Fed index, Fedspeak come next in the NA session.

The European currency regains a small smile and motivates EUR/USD to rebound from earlier lows in the mid-0.9700s on Thursday.

EUR/USD supported near 0.9750 so far

EUR/USD manages to regain some buying interest and recoup part of the ground lost following Wednesday’s strong decline, retargeting the 0.9800 region amidst the so far tepid downside momentum in the dollar.

Also underpinning the daily uptick in spot, the German 10-year benchmark bund yields rise past the 2.45% level for the first time since August 2011, in line with the uptrend observed in their US pees across the curve.

In the domestic calendar, the EMU’s Current Account deficit widened to €26.32B in August.

Across the pond, usual weekly Initial Claims are due followed by the Philly Fed manufacturing gauge, the CB Leading Index, Existing Home Sales and speeches by FOMC’s Harker, Jefferson, Cook and Bowman.

What to look for around EUR

EUR/USD’s weekly corrective move seems to have met some decent contention near 0.9750 for the time being amidst the ongoing knee-jerk in the dollar.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Following latest results from key economic indicators, the latter is expected to extend further amidst the ongoing resilience of the US economy.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: European Council Meeting, EMU Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is advancing 0.02% at 0.9776 and faces the next up barrier at 0.9875 (weekly high October 18) followed by 0.9999 (monthly high October 4) and finally 1.0050 (weekly high September 20). On the flip side, the breakdown of 0.9631 (monthly low October 13) would target 0.9535 (2022 low September 28) en route to 0.9411 (weekly low June 17 2002).