Our best spreads and conditions

Learn more

Learn more

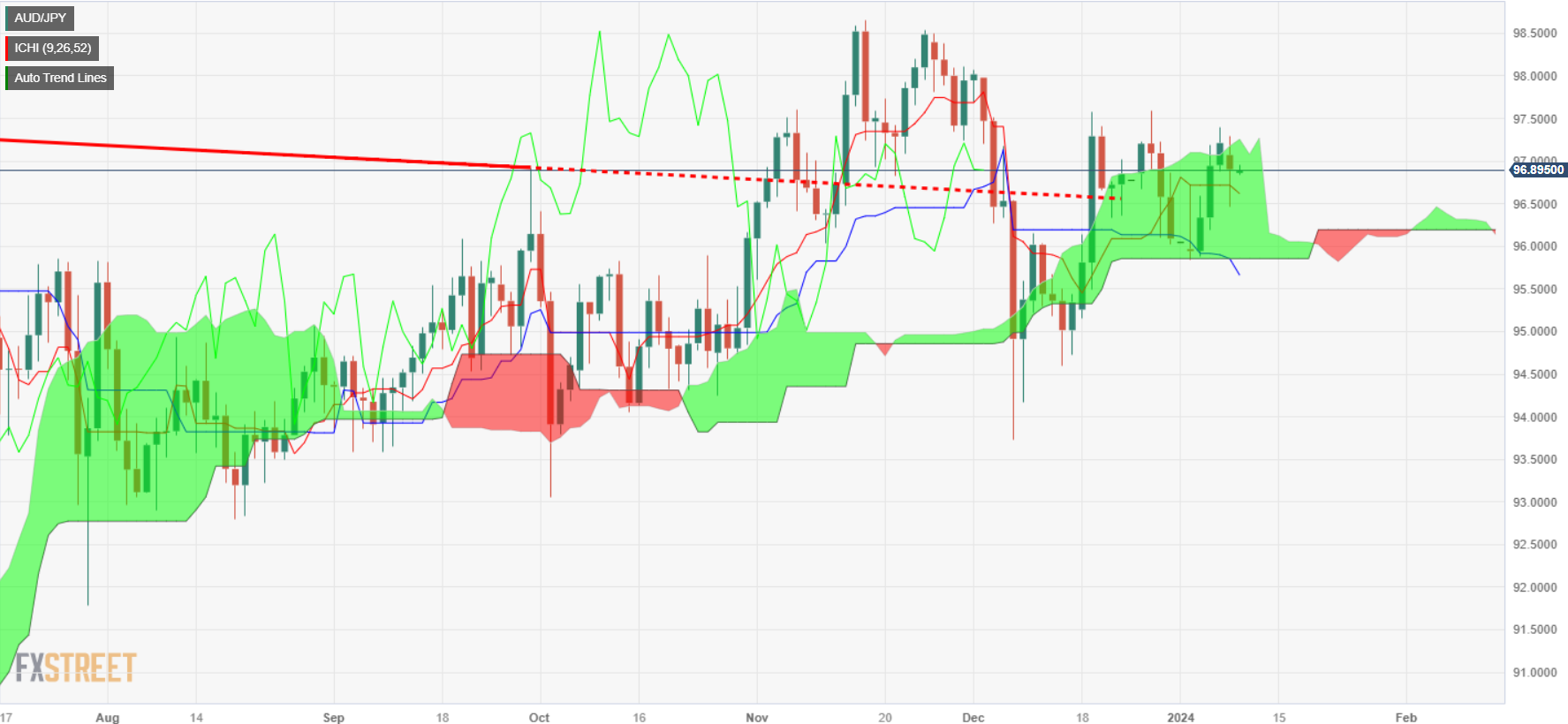

The AUD/JPY registered modest losses of around 0.20% on Monday despite market sentiment shifting positively, usually a headwind for the safe-haven status of the Japanese Yen (JPY). Consequently, the cross-pair is trading at 96.80, after hitting a daily high of 97.27.

From a technical perspective, the AUD/JPY is range-bound though slightly tilted to the upside, with the pair hovering near the top of the Ichimoku Cloud (Kumo), and above the Tenkan-Sen and the Kijun-Sen. Nevertheless, a breach of the former at around 96.71, could pave the way for challenging the latter just below the 96.00 figure, at 95.82.

Given the backdrop, the AUD/JPY first resistance level is the 97.00 figure. Followed by the January 5 swing high at around 97.39. if buyers step in and push the prices above that level, up next would be the December 27 high at 97.59, followed by the 98.00 mark.