AUD/JPY Price Analysis: A long way to recovery

- AUD/JPY bounces off the 15-week low.

- The short-term falling trend line, key SMAs stand tall to challenge buyers.

- Fresh selling pressure could recall early-October 2019 levels.

AUD/JPY recovers to 73.80 amid the initial Asian session on Wednesday. The pair recently took a U-turn from the lowest since mid-October but is yet to clear the key upside barriers.

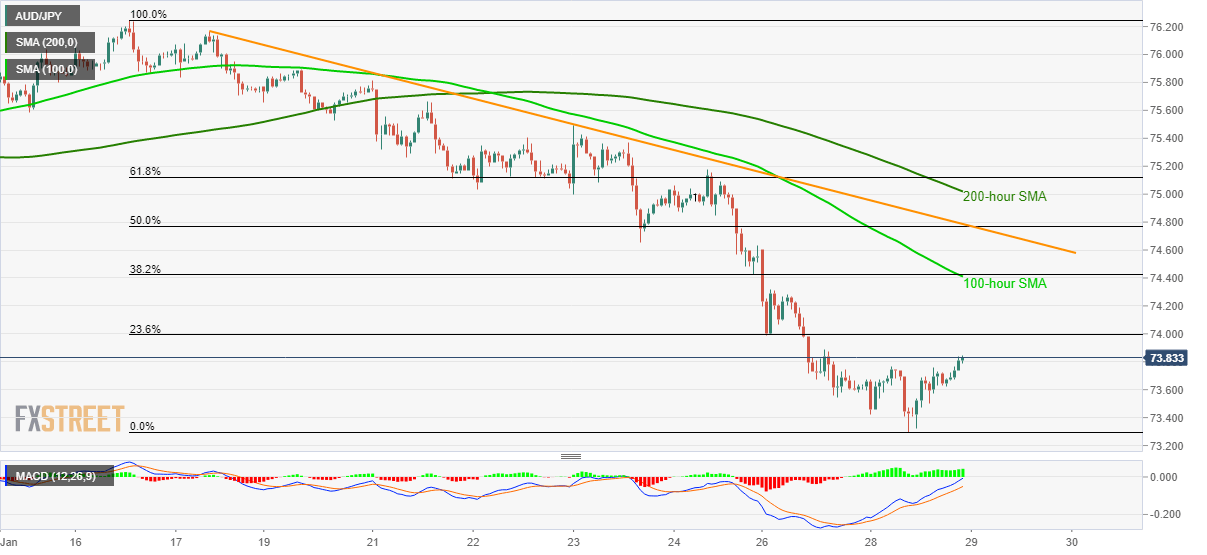

Among the immediate hurdles to the north, a confluence of 100-hour SMA and 38.2% Fibonacci retracement of its fall from January 16 to 28, around 74.40/45, holds the nearest gate.

Following that, a descending trend line since January 17 at 74.80 and 200-hour SMA near 75.00 precede 61.8% Fibonacci retracement level of 75.12.

If at all the bulls manage to conquer the key Fibonacci retracement, it’s the run-up to the previous week’s top near 75.90 becomes likely.

Meanwhile, sellers await fresh entry if AUD/JPY prices fall below the recent low of 73.30. In doing so, the early October 2019 high close to 72.55 and the October month bottom surrounding 71.75 will be on their radars.

AUD/JPY hourly chart

Trend: Bearish