Back

5 Feb 2020

USD/CHF Price Analysis: Registers three-day winning streak, probes 21-day EMA

- USD/CHF extends recovery from mid-January lows.

- A ten-week-old falling trend line, short-term horizontal resistance area will challenge the pair’s latest pullback.

- The pair’s break of yearly low can push the bears towards late-2018 lows.

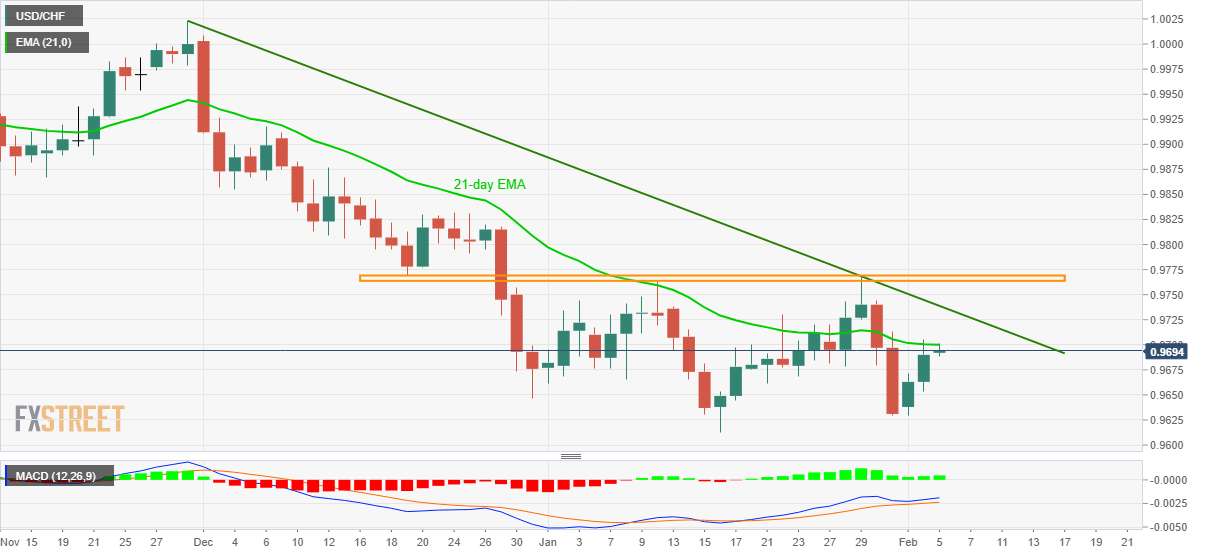

USD/CHF takes the bids to 0.9700 during the pre-European session on Wednesday. That said, 21-day EMA limits the pair’s immediate upside amid the bullish MACD signals.

Even if the pair manages to clear the 0.9700 mark on a daily closing basis, a downward sloping trend line since November 29, at 0.9740, will stand tall to question the buyers.

Additionally, 0.9770/63 area including December 12, 2019, low and highs marked from January could keep a tab on the bulls past-0.9740.

Meanwhile, the last week’s low near 0.9660 and the yearly bottom surrounding 0.9613 can take rest around 0.9600 ahead of challenging September 2018 trough close to 0.9540.

USD/CHF daily chart

Trend: Pullback expected