Back

6 Feb 2020

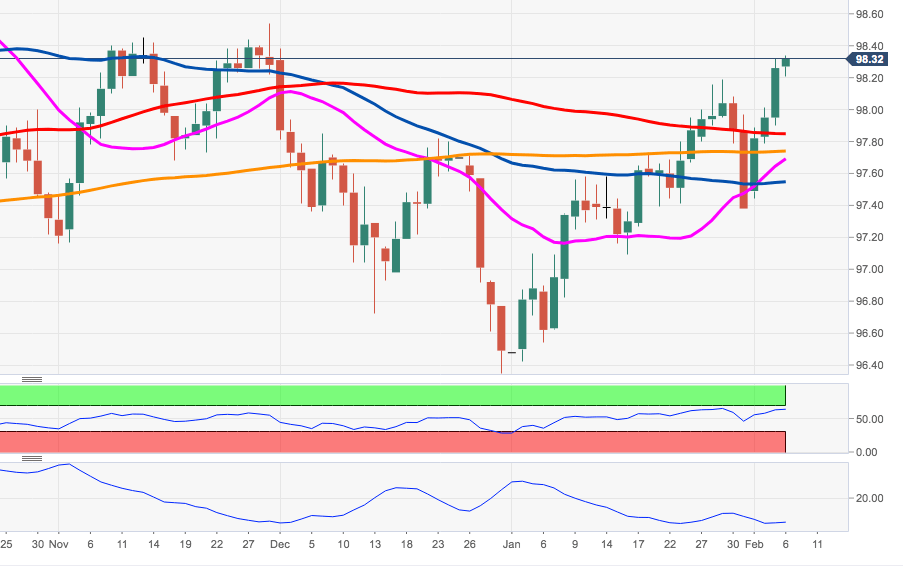

US Dollar Index Price Analysis: Further upside should test 98.54

- DXY clinched fresh 2020 highs beyond 98.30 during early trade.

- Further north emerges the November’s peak at 98.54.

The rally in DXY stays everything but abated on Thursday, managing to record new yearly highs in the 98.30/35 band earlier in the session.

Following the breakout of the 200-day SMA around 97.70, the index is now navigating the area above the 98.00 mark and has shifted the focus to 98.54, November 2019 peak.

While above the 200-day SMA, the dollar’s outlook should remain constructive.

DXY daily chart