Back

17 Feb 2020

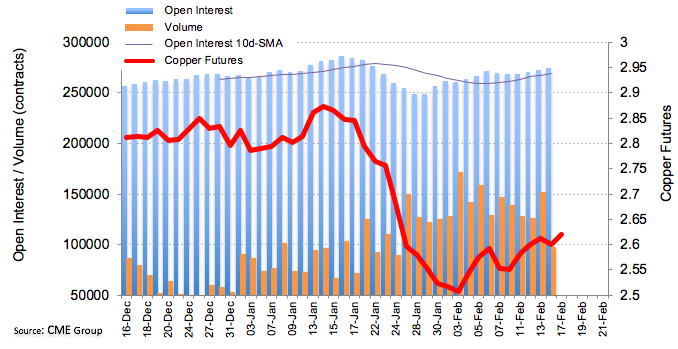

Copper Futures: Neutral near-term

CME Group’s advanced prints for Copper futures markets noted traders added nearly 2.5K contracts to their open interest positions on Friday, reaching the fourth build in a row. Volume, instead, shrunk by almost 54K contracts, resuming the downside.

Copper prices face some consolidation

Friday’s retracement in prices of the base metal was on the back of rising open interest, opening the door to a deeper pullback in the near-term. However, the moderate drop in volume could remove tailwinds from the potential decline and spark some consolidation instead.