Back

28 Feb 2020

USD/JPY New York Price Forecast: Dollar slumps near four-week’s lows vs. yen

- USD/JPY is dropping sharply below the 110.00 figure as the market is nearing the 200-day SMA.

- The level to beat for bears is the 108.25 support.

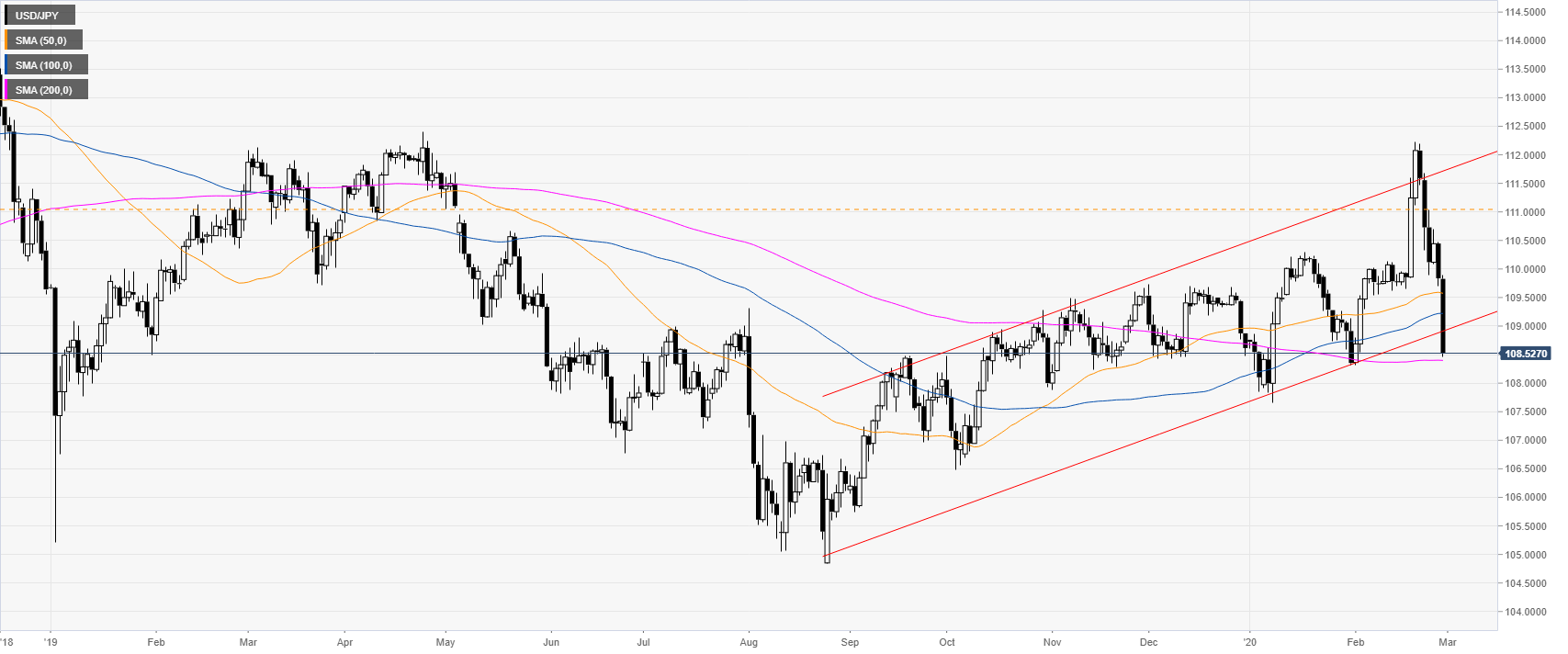

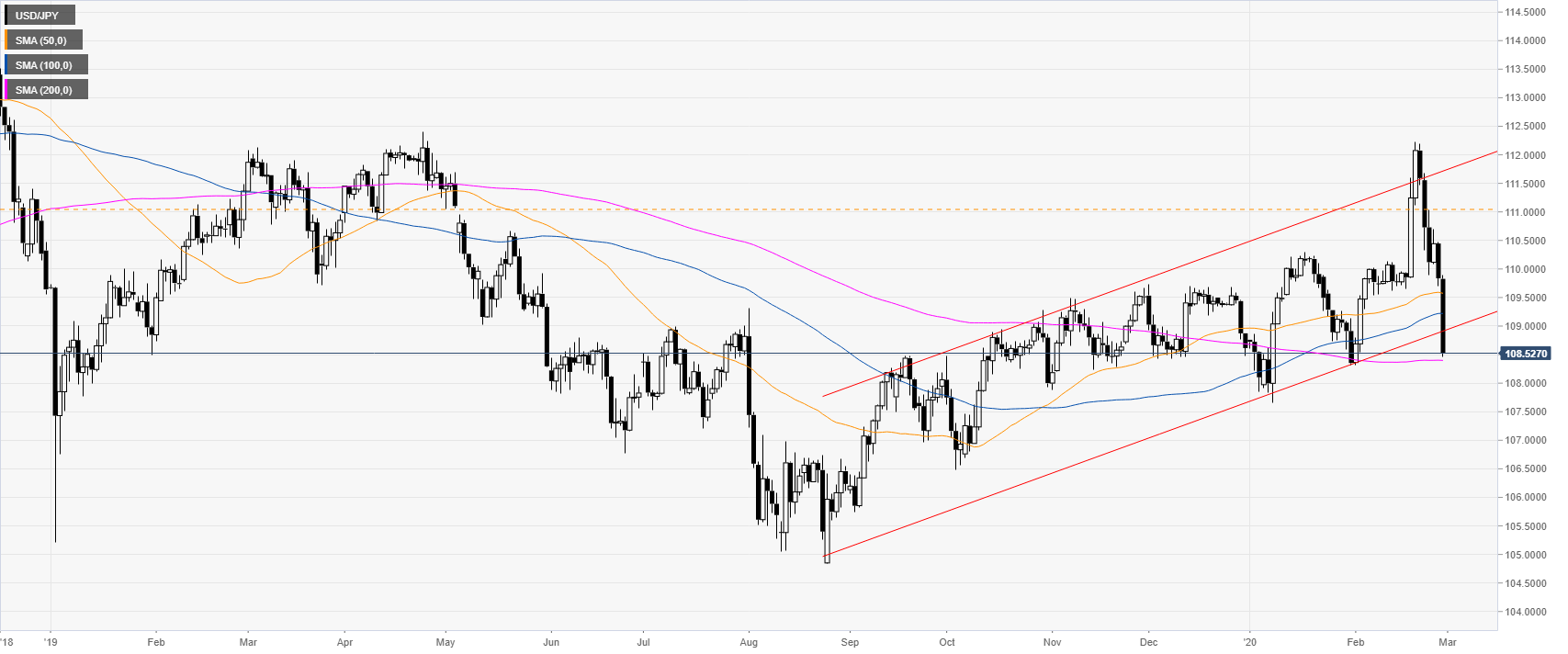

USD/JPY daily chart

USD/JPY is reversing down sharply from the 2020 tops while nearing the 200-day simple moving averages (SMA).

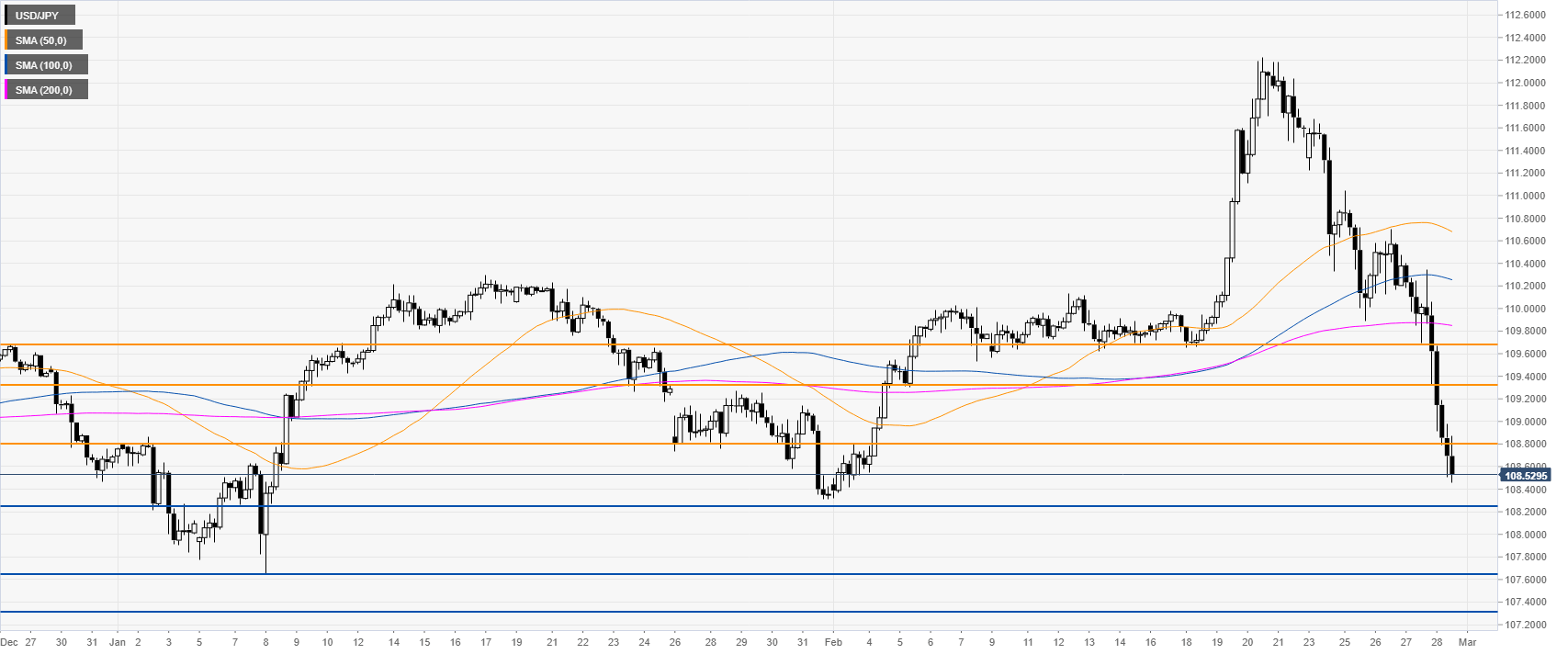

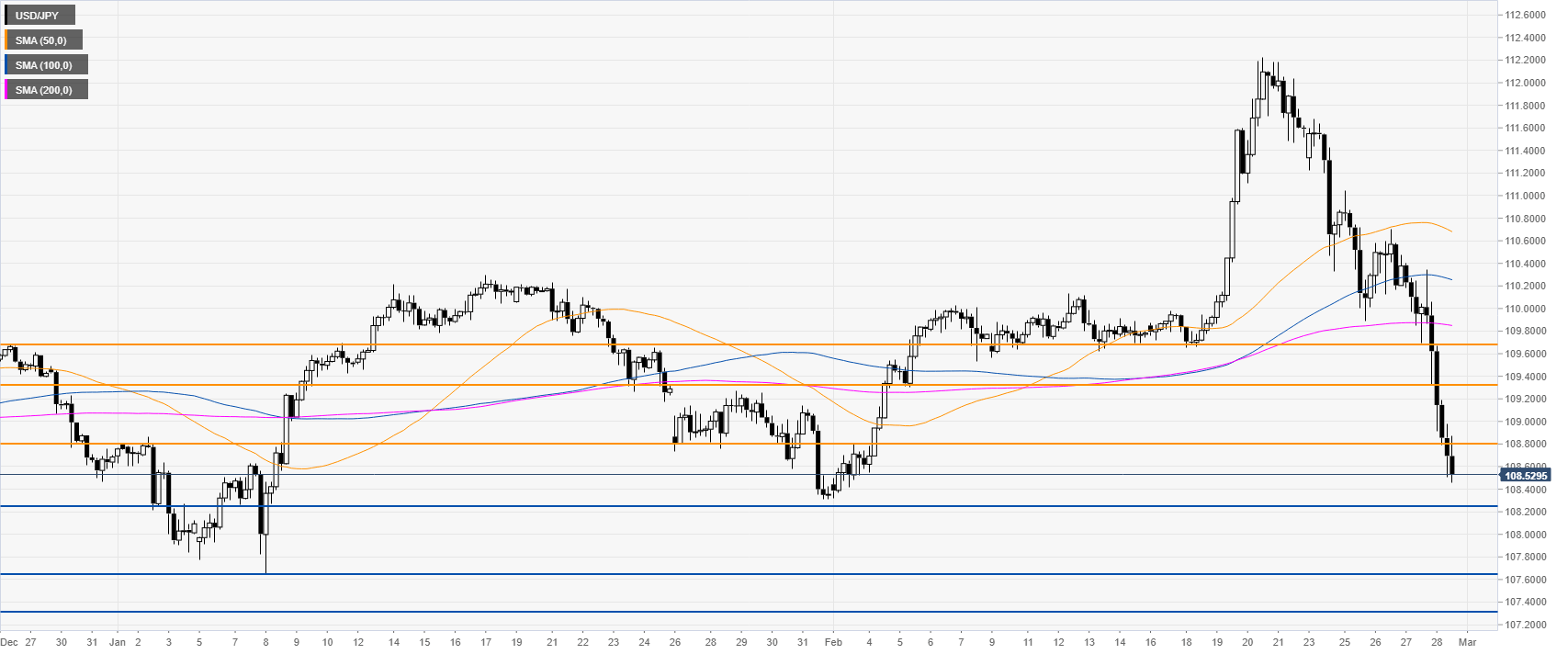

USD/JPY four-hour chart

USD/JPY lost about 150 pips since the New York close on Thursday. The spot remains weak as sellers remain in control. The market as potentially rooom to fall further towards 108.25, 107.65 and the 107.35 level the way down. Resistances can be expected near the 108.78 and 109.34 levels

Resistance: 108.78, 109.34, 109.68

Support: 108.25, 107.65, 107.35

Additional key levels