Gold Price Forecast: Bears taking over as US dollar firms

- Gold is trapped between resistance and key support.

- The US dollar is creeping higher in a correction from Fed and profit-taking induced daily lows.

The price of gold was pushed to a critical support area on the daily chart on Friday and is starting out the week consolidating there waiting for a catalyst.

At the time of writing, XAU/USD is flat at $1.813 sticking to a $2.00 range ahead of the Tokyo open.

On Friday, the price was falling to a low of $1,810.23, ending 0.75% lower to $1,814 by the close of Wall Street after reaching a high of $1,831.41.

The greenback has recovered some partial ground since suffering its worst week in nearly two months due to the build-up and outcome of the Fed.

However, hawkish Fed comments and data released on Friday helped to spark up demand once again for the greenback.

Data showed annual inflation accelerating further above the Federal Reserve's 2% target.

St. Louis Federal Reserve President James Bullard argued that the Fed should start reducing its $120 billion in monthly bond purchases this fall and cut them "fairly rapidly".

He advocates this so that the program ends in the first months of 2022 to pave the way for a rate increase that year if needed.

The comments sank gold prices as the dollar rallied back into the 92 handle.

Meanwhile, the market's took an interest in the Fed’s chair Jerome Powell’s more dovish than expected comments in the presser last week which concluded the FOMC’s two-day meeting, sinking the greenback.

Powell explained that a rate hike was a way off and expressed the importance of job creation rather than being fixed on inflation readings.

This means that the US data will be very closely watched in the next couple of weeks leading into the 26-28 Aug Jackson Hole Symposium.

Hawkishly, tapering was mentioned in the official Fed statement for the first time this cycle, with the Fed noting that there has been some progress made towards the goals laid out to justify tapering.

This means that there are prospects of a shorter timeline for actual tapering.

Therefore, an explicit tapering statement could be made as soon as the Jackson Hole followed by actual tapering seen by year-end.

This puts this week's jobs data at the forefront of trader's minds.

Nonfarm Payrolls will be a critical event for both the US dollar and gold prices because investors will speculate that an improvement in the data will likely firm bets of a tapering announcement later in the month.

It could be just the ticket for the US dollar to recover from the profit-taking and month-end sell-off.

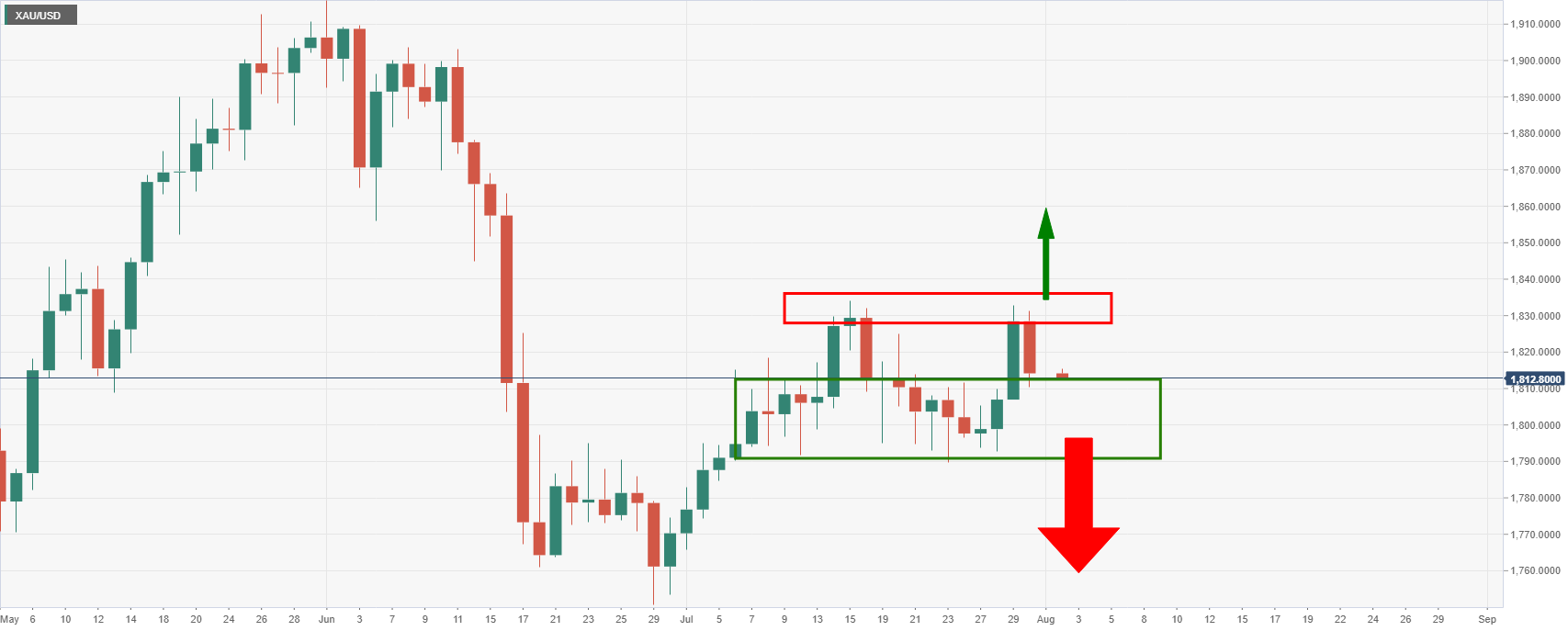

Gold technical analysis

From a technical stance, the bulls will need to clear 1,834 to harden the outlook from a longer-term perspective.

In doing so, the weekly bullish reverse head & shoulders in development will be a compelling feature for the foreseeable future.

A 61.8% Fibonacci target of the weekly bearish impulse comes in near 1,850 for a near term target:

However, if the price breaks 1,800 followed by a 4th weekly successful test of 1,790 this time around, the tables will have turned and the bears will be well on their way to the 1,750s that will guard the 1,730s:

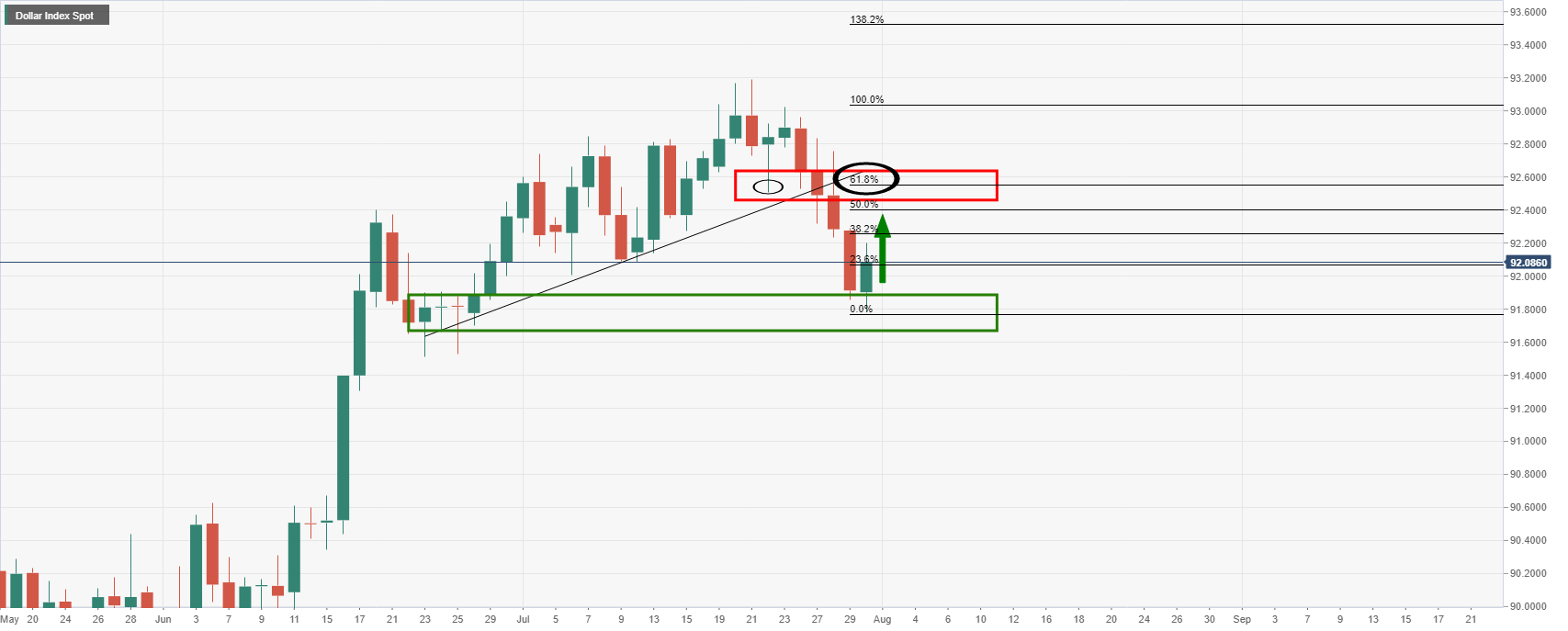

DXY, daily chart analysis

The bulls are attempting to recover from cycle lows which is bearish for gold in the near term:

Bulls can target a confluence of old support and the 61.8% Fibo of the latest bearish impulse near 92.50.