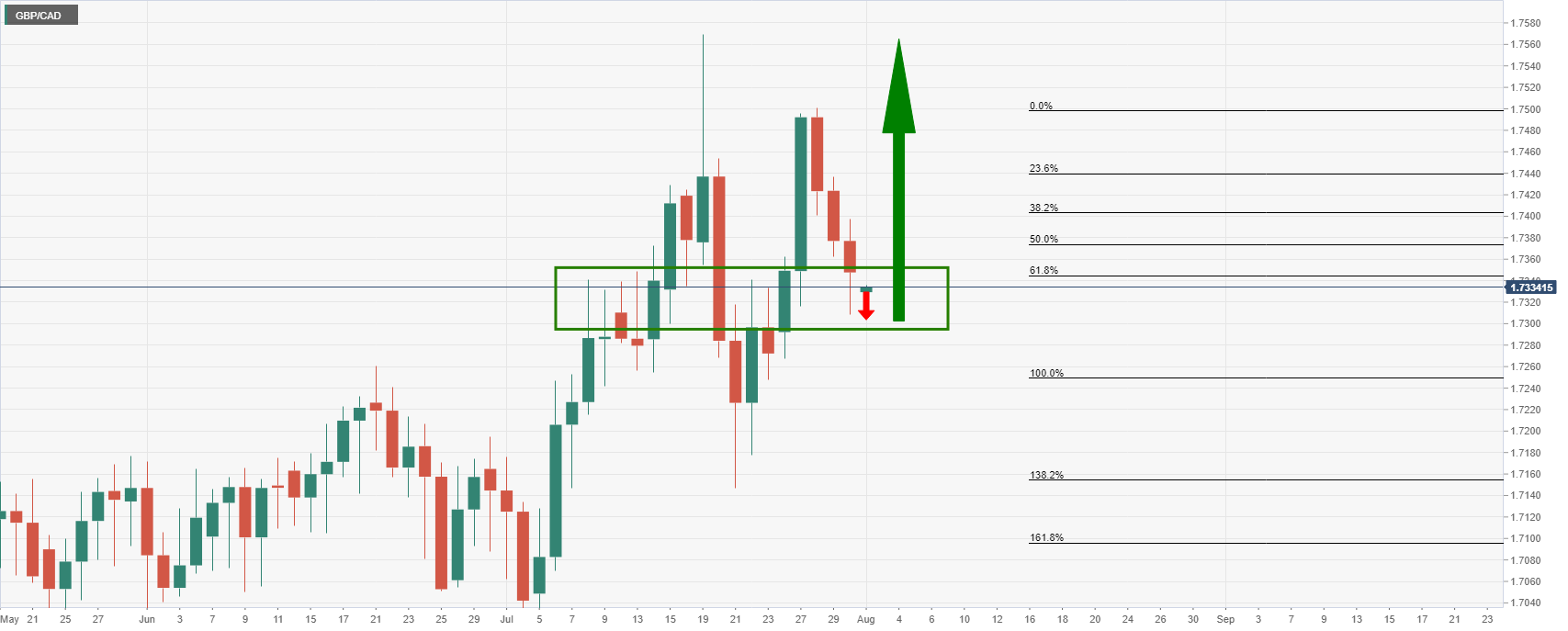

GBP/CAD Price Analysis: Bears seek deeper correction, bulls eye daily extension

- GBP/CAD is aligned for a bullish continuation on the daily chart.

- In the immediate term, there are prospects to test 1.7280 first.

GBP/CAD is offering prospects of a near term day trade to the downside on a break of hourly support prior to a high probability of a bullish continuation on the longer-term charts.

The following top-down analysis illustrates the possibilities based on current price action and market structure.

Daily chart

While there are still prospects of a deeper test of the demand area to 1.7280, the prior bullish impulse printed a fresh closing high and the subsequent correction is decelerating.

This raises prospects of a continuation for a daily higher-high in the coming days.

Bulls can be on the lookout for an optimal entry from a bullish structure.

4-hour chart

The 4-hour chart shows that the price would need to at least close above 1.7390 before a set-up could be established above resistance that would be then expected to turn new support.

Hourly chart

Meanwhile, from an hourly perspective, there are prospects of a short taken on a break of current hourly support of 1.7320 to target deeper into demand territory in the low 1.7280s.